A cash flow statement, along with the balance sheet and income statement, is one of the primary financial statements used to measure your company’s financial position. It tracks the cash inflow and cash outflow of cash from operating, investing, and financing activities during a given time period. The term “cash” refers to both cash and cash equivalents, which are assets readily convertible to cash. This financial statement provides relevant information to assess a business’s liquidity, quality of earnings, and solvency. QuickBooks offers more — and better — reports than nearly any other accounting software provider.

Get your free Excel cash flow statement template

QuickBooks Online syncs with more than 750 different third-party business apps, ranging from point-of-sale apps to payment acceptance tools and beyond. Naturally, QuickBooks Online syncs with other QuickBooks products as well, including QuickBooks Time (formerly TimeTrex), TurboTax and QuickBooks Online Payroll. QuickBooks Payroll starts at $45 a month plus $6 per employee paid per month, and new users can choose between a 30-day free trial or 50% off discount just as they can with QuickBooks Online. While QuickBooks Self-Employed is a passable income-tracking and invoicing app for the self-employed, it’s pricier than other freelance-friendly accounting tools like Wave Accounting and Xero. Most CEOs and small business owners understand the value of creating budgets, however, it can be painful if you don’t have the resources in place to work through the process.

Investing activities

Alternatively, you can easily create a cash flow statement based on an accounting system such as QuickBooks. Intuit QuickBooks Online’s powerful, cloud-based accounting solution helps businesses of all sizes manage their finances. It’s one of the highest-rated and most popular bookkeeping software services — and for good reason. Few accounting software programs https://www.quickbooks-payroll.org/ are as fully featured as QuickBooks Online, which lets users track expenses, reconcile bank accounts, generate critical financial reports and much more. The final category on the balance sheet shows all cash transactions that had to do with financing activities. Things that would go in this category include activities that involve debt, equity, or dividends.

Cash Flow vs. Profit

The software ensures it is prepared to keep into consideration all necessary aspects. With accounting software options like QuickBooks’ small-business products, detailed financial information about your business is always at your fingertips. Financial statements — such as a profit and loss statement, balance sheet or statement of cash flows — are a window into the health of your business and help you spot problems and opportunities. Understanding your company’s cash flow is critical to maintaining a positive cash flow. It’s important to identify the key cash drivers for your company’s operations, as well as understanding how the current period (i.e. month, quarter, or year) compares to a prior period.

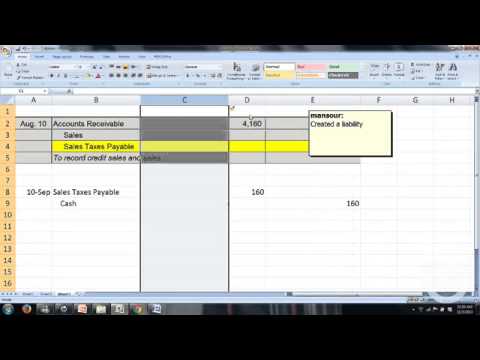

Our cash flow statement template can be customised to include the specific types of cash flow activities that apply to your company. To fill out this spreadsheet, enter the applicable values in their respective cells. The total amounts automatically populate based on the embedded formulas. An example cash flow statement is also included to help guide you through the process.

We also carefully read through individual user reviews on sites like Gartner Peer Insights and Trustpilot to ensure we wrote a balanced, fair review that took multiple perspectives into account. QuickBooks has an accounting tool specifically for freelancers called QuickBooks Online Self-Employed, which starts at $15 a month. QuickBooks Self-Employed tackles basic freelance bookkeeping features like expense tracking, receipt uploading, tax categorizing, quarterly tax estimating and mileage tracking. Cash flow represents the money moving in and out of a business, whereas profit is what an organization has after subtracting all of its expenses from its revenue. We provide the budgeting services and cash flow tools and analysis you need to keep your finger on the financial pulse. Analyzing cash flow trends helps in identifying potential risks and opportunities, thereby allowing proactive measures to be taken to mitigate risks and capitalize on favorable trends.

- As an accounting program, QuickBooks Online helps you track your finances while giving you clear insights that can guide your most crucial business decisions.

- Non-cash items that are taken into account include depreciation, amortisation, account receivable loss provisions, and losses from the sales of fixed assets.

- It is no doubt a powerful tool so you can see what the future holds for your business and what decisions you can make based on it.

You get a good look at the next six weeks of your company's financial future, which works well when you're ensuring that all the bills and employees will get paid in the next month. A close eye on cash flow helps in planning for investments, managing debts, and seizing profitable opportunities, contributing to the overall success of the business. It plays a crucial role in providing insights into a company’s liquidity and solvency, helping in evaluating its ability to meet financial obligations.

Keep in mind that you can view the report in QuickBooks, email the report to yourself or someone else or export it as a new file. In this lesson, we’ll teach you how to run a statement of cash flows in QuickBooks Online. You’ll learn https://www.personal-accounting.org/understanding-a-balance-sheet-definition-and/ how to set up general options for your cash flow statement and how to customize it using the different elements available in QuickBooks. Yes, you can use an Excel cash flow template to help you create a cash flow statement.

A cash flow statement is used to attract new investments, inform your fundraising efforts, and get more access to financing options. For banks and creditors, your cash flow statement provides some reassurance that your small business is able to pay back its loans or fund its own operating expenses. Profit refers to the difference between revenue and cost over a period of time, whereas cash flow measures your cash on hand. A small business may be profitable but still not have the cash needed to pay employees, vendors, or creditors. Businesses need to manage cash flow to ensure that there is enough money coming in to pay the bills today. Many small businesses strive to get a better handle on money coming in and going out.

By understanding the components of the cash flow statement and reconciling it regularly, businesses can gain a comprehensive view of their cash position and ensure financial stability and growth. If you have questions or want to learn more about our Client Advisory Services, please contact us. To create a cash flow statement manually, select a time period and review your income and expenses in each of the three activities discussed above. Use a self-created spreadsheet or download our excel cash flow template to organise your data into a cash flow statement. Essentially, your entries show cash in and cash paid out each month for the time period that your cash flow statement covers. A cash flow statement includes actual cash transactions, while an income statement can list non-cash receipts.

Owens also recommends looking at the financing section, particularly to see if the business is bringing in most or all of its cash from loans or other sources of financing.”This isn't always a bad thing,” she says. But if most of the money is coming from financing, it's worth taking a second look, especially if the money will eventually need to be repaid.In general, the more cash that comes from operations, the better, Owens says. Assets are composed of cash and near-cash assets such as short-term liabilities, while liabilities would include money you owe to vendors and employees, as well as taxes you must pay. Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Online.

CHANGES TO PRIOR PERIODS This issue causes problems with all three of the financial statements. Once a period is complete, all of the accounts are reconciled, and financials have been issued, there should be no more changes to that period or earlier. By simply using the Closing Date and Password functionality of QuickBooks, the company can lock prior periods and protect them from any attempts to add to, delete from, or change any transactions in the closed periods. This is easy to use and can save the business from a lot of headaches in the near and long-term, not to mention safeguard the accuracy of it’s reporting. Though companies already have income statement to show their earnings, it is not confined to cash transactions only.

This statement is instrumental in financial management, aiding in the assessment of a business’s ability to meet its obligations and pursue growth opportunities. A cash flow statement is a financial statement that provides an overview of the cash inflows and outflows within a business, offering markup pricing definition advantages disadvantages formula & overview insights into its financial performance and liquidity. QuickBooks Online, our overall best small business accounting software, lets you customize any type of report, including cash flow statements. You can customize various aspects of the report, including data range, columns, and headers.

For example, a working capital line of credit is often coded as a current liability. QuickBooks assumes this account should be in the operating section of the cash flow, but that is not always the case. A line of credit is usually reported in the investing section of the statement.

The business model and type could also determine whether a shorter or longer term cash flow forecast (other than the 13-week rolling) might be needed. For one thing, it limits the number of invoices its customers can send each month to 20 with the cheapest plan. The lowest-tier plan users are also limited to managing just five bills a month and creating 20 estimates a month.