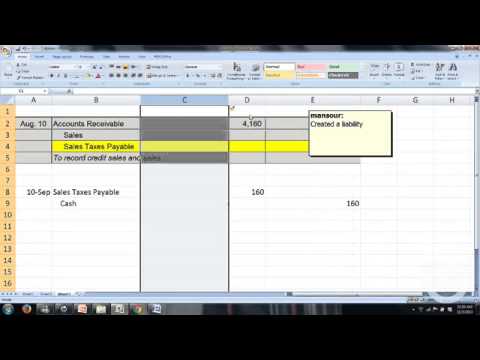

When the goods or services are provided, this account balance is decreased and a revenue account is increased. An example of revenue accrual would occur when you sell a product for $10,000 in one accounting period but the invoice has not been paid by the end of the period. You would book the entry by debiting accounts receivable by $10,000 and crediting revenue by $10,000. For example, a client may pay you an annual retainer in advance that you draw against when services are used.

Expense vs. Revenue

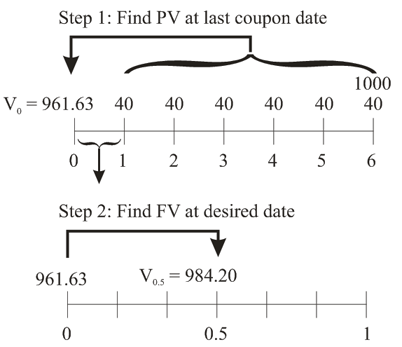

ABC debits the cash account and credits the unearned revenue liability account, both for $10,000. ABC delivers the related goods in the following month, and credits the revenue account for $10,000 and debits the unearned revenue liability account for the same amount. Thus, the unearned revenue http://andreyfursov.ru/news/levyj_demarsh/2015-03-20-413-987 liability account was effectively a holding account until ABC could complete the shipment to the customer. In accounting, a deferral refers to the delay in recognition of an accounting transaction. A deferral is used in order to only recognize revenues when earned and expenses when consumed.

Example of Deferred Revenue

Further, under the same projections, the state would end this year with nearly $100 billion in unused borrowable resources (balances in other state funds). These funds would be available to cover any cash deficits that could occur in subsequent months. Deferral contributions to a 401(k) are the portions of an employee’s salary they elect to postpone receiving until later. Income taxes on these funds, as well as any employer-matching contributions and investment earnings, are deferred until withdrawn later on, typically in retirement. A current asset representing the cost of supplies on hand at a point in time.

- This is so because per accrual accounting, the recognition of revenue is not complete.

- These funds would be available to cover any cash deficits that could occur in subsequent months.

- However, what's being deferred in those cases is payment, not the recording of it, such as with accounting deferrals.

- This additional funding can significantly boost an individual's retirement savings over time.

- Both options provide tax advantages and a wide range of investment choices, depending on the employee's needs and preferences.

Guide to Understanding Accounts Receivable Days (A/R Days)

Download this valuable resource to serve as a reference as you explore the significant role of deferrals in understanding a government's financial health. A diversified portfolio that aligns with the employee's risk tolerance and financial goals can help maximize retirement savings and minimize investment risks. The Thrift Savings Plan is a retirement plan specifically for federal employees and members of the uniformed services. Traditional 401(k) plans allow employees to contribute pre-tax dollars, while Roth 401(k) plans involve after-tax contributions, with tax-free withdrawals during retirement. Investment choices may include various mutual funds, stocks, bonds, and other financial instruments. This flexibility enables individuals to tailor their retirement savings strategy to their unique needs and preferences.

Ask a Financial Professional Any Question

Other expenses that are deferred include supplies or equipment that are bought now but used over time, deposits, service contracts, or subscription-based services. The receipt of payment doesn’t impact when the revenue is earned using this method. When the products are delivered, you would record it by debiting deferred revenue by $10,000 and crediting earned revenue by $10,000. SIMPLE IRAs allow employees to make pre-tax contributions and provide mandatory employer contributions, either through matching or non-elective contributions. Investment options in a SIMPLE IRA are typically broader than those in 401(k) and 403(b) plans, but contribution limits are lower. Like 401(k) plans, 403(b) plans allow pre-tax contributions and offer tax-deferred growth, along with the possibility of employer matching contributions.

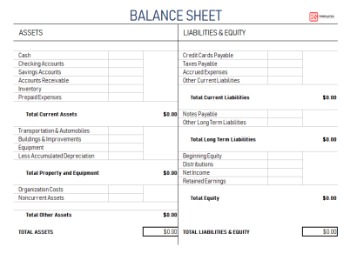

Accruals & Deferrals

The concept is used under the accrual basis of accounting, but not under the cash basis of accounting. A revenue deferral is an adjusting entry intended to delay a company’s revenue recognition to a future accounting period once the criteria for recorded revenue have been met. Instead, the amount will be classified as a liability on the magazine’s balance sheet. As each month during the subscription term is realized, a monthly total will be added to the sales revenue on the income statement, until the full subscription amount is accounted for. During these same time periods, costs of goods sold will reflect the actual cost amounts to produce the issues that were prepaid. Governor’s Budget Proposes Not Recognizing the Expenditures Above the Minimum Requirement, Despite Allowing Schools to Keep the Funding.

Want More Helpful Articles About Running a Business?

By participating in a retirement plan that allows elective https://abireg.ru/n_63448.html, employees can accumulate wealth over time and ensure a comfortable retirement. Moreover, many employers offer matching contributions, further increasing the employee's retirement savings potential. In regard to expenses, a company may pay a supplier in advance, but should defer recognition of the related expense until such time as it receives and consumes the item for which it paid. In the case of the deferral of a revenue transaction, you would credit a liability account instead of the revenue account. In the case of the deferral of an expense transaction, you would debit an asset account instead of an expense account.

In short, there is no receipt of cash payment for an accrual, whereas there is a payment of cash made in advance for a deferral. Accrued revenue are amounts owed to a company https://aviakassir.info/news/airlines/6794-at-royal-air-maroc-agent-debit-memo-policy.html for which it has not yet created invoices for. The reasons players listed were varied, but mostly involved an organization’s lack of spending or player development.